Grande’s theory is partly true: Buying stuff you don’t need may not make you any happier, but having enough money for your needs (and at least some of your wants) alleviates stress and can help you achieve a better quality of life. ‘Whoever said money can’t solve your problems must not have had enough money to solve ’em’ -Ariana Grande (Here’s more about spousal IRAs and how they work.) Single parents can contribute to IRAs as well, as long as they have earned income. Because of the tax advantages, IRAs typically require contributors to have earned income however, spousal IRAs allow you to contribute based on your spouse’s income, as long as you file taxes jointly and your spouse makes enough to cover your contribution. There may be no 401(k), but you can open a spousal IRA.Īn IRA is a retirement account you open on your own. Stay-at-home parents should treat the work they do like any other full-time job and think about saving for retirement. Gretchen Wilson’s country ode to the trials of being a mother points out the obvious about unpaid work (often) performed by women: There’s no paycheck, and there are no benefits. ‘Lousy pay, there ain’t no 401(k), I know this may come as a shock, but this here’s a full-time job’ -Gretchen Wilson If you can, arrange to have a portion of each paycheck go directly to savings. Some employers even let you split your direct deposit between different accounts. Having a dedicated savings or investment account can help you safeguard your money and keep yourself from spending it. If you keep the money you save in your checking account, it may not stay saved for long. From cutting your cable bill to making a budget to refinancing a loan, there are lots of ways to “grab that cash,” even when things feel tight. Making money and putting it away is the basis of any saving or investment advice. This may be obvious (and easier to do when you’re ultra-famous), but Pink Floyd has a point. ‘Grab that cash with both hands and make a stash’ -Pink Floyd Cash management accounts, which are offered by investment firms like online brokers and robo-advisors, are similar to savings accounts and also offer high interest rates. Many offer rates even a Material Girl would approve of: Currently, 1.60% or more, which is significantly higher than the national average savings account rate of 0.09%.

If your precious cash is sitting in a traditional brick-and-mortar savings account, it’s time to change it up: Think about opening a high-yield savings account. ‘If they can’t raise my interest then I have to let them be’ -Madonna One is choosing an inexpensive type of mutual fund called an index fund, which invests in an entire stock market index - for example, the S&P 500. You will pay an annual fee to invest in a mutual fund, but there are ways to cut costs. Mutual funds can help investors quickly and easily diversify their portfolio and avoid having to pick individual stocks themselves. Unlike stocks, which are investments in a single company, mutual funds are portfolios of investments - one mutual fund might hold hundreds of different stocks or bonds. One way to diversify your portfolio is through mutual funds. ‘Floss a lil’, invest up in a mutual fund’ -Busta Rhymes They’re cheaper than human financial advisors, and you don’t have to worry about managing your investments yourself. Robo-advisors are automated investing services that help you choose investments and manage your portfolio.

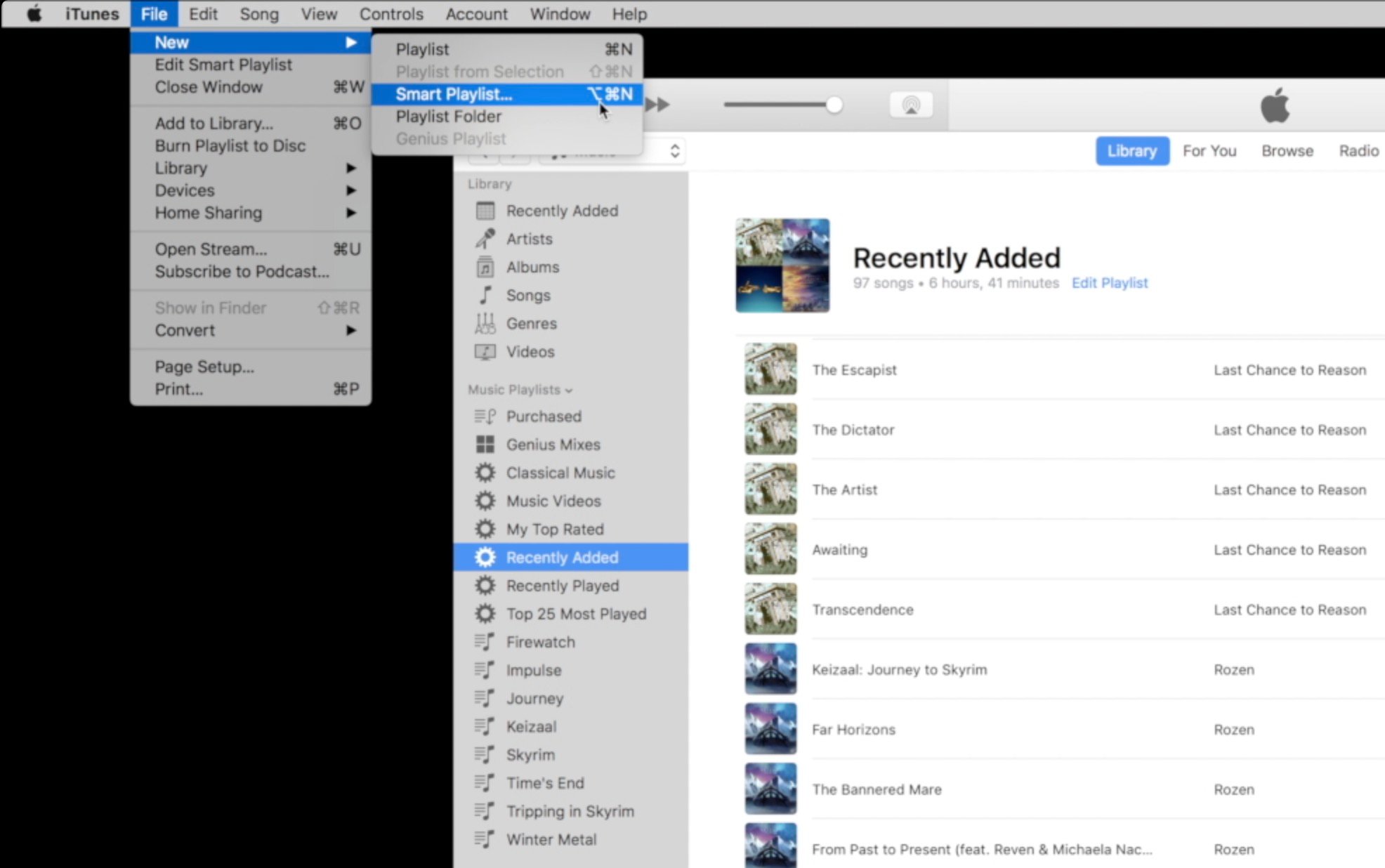

Playlist assist how to#

If you’re not sure how to diversify your assets or would like some help, think about using a robo-advisor. Diversifying is one of the best ways to safeguard your investment portfolio against risk. When you diversify, you spread your money across not just different types of investments - like stocks and bonds - but also across investments from various industries and geographic locations. If you invest all your money into a single stock or bond and that investment loses its value, you’ll be out some serious cash.

Made famous by the “Wu-Tang Financial” sketch on “Chappelle’s Show,” this line gives some sage advice: Diversification is one of the most important aspects of investing. Over the decades, many pop stars, and rock, country and rap artists have offered catchy advice that can remind you to stick to your personal finance goals. Next time you’re looking for financial advice, ignore your opinionated uncle and turn on Spotify.

0 kommentar(er)

0 kommentar(er)